DAC6 for Fiduciaries: Example 1 – Financial Asset Conversion

The following transcript is an extract from the BlueBridge Webinar of 25 February 2021, entitled DAC6 for Fiduciaries – Part II llustrative Examples of how the EU’s Intermediary Disclosure Regime Affects Trustees and other Fiduciaries. On 21 January, BlueBridge had presented a webinar on DAC6 for Fiduciaries, pursuing the following inquiries on the impact of DAC6 on fiduciaries:

Due to time limitations, however, we set up a subsequent webinar in which we explored three concrete examples: The financial asset conversion scenario, a private wealth structure set-up scenario and the representative single family office scenario. The following is lifted from our DAC6 Fiduciary Examples’ webinar, including these items:

You can access the 25 February 2021 webinar video and slides here.

|

Description of Scenario |

Concepts and Hallmarks (HMs) |

|

Trust with EU Beneficial Owner converts a portfolio of marketable securities into equivalent derivative contracts |

|

Transcript extract [Paul Millen speaking….]

In the first scenario, we have a trust, we have an EU beneficial owner of that trust, and the trust holds a portfolio of marketable securities with the bank and converts those marketable securities into derivative contracts that reference the same underlying marketable securities. And the simple transaction yields a series of concepts to explore the DAC6, including the definition of cross-border, and what makes something a Cross-border Arrangement, the definition of an Intermediary, the consequences of no EU nexus for any Intermediaries and how that affects the Relevant Taxpayers, the clients as I mentioned before, and then the role of Legal Professional Privilege, its scope and what the implications of an Intermediary invoking Legal Professional Privilege could be.

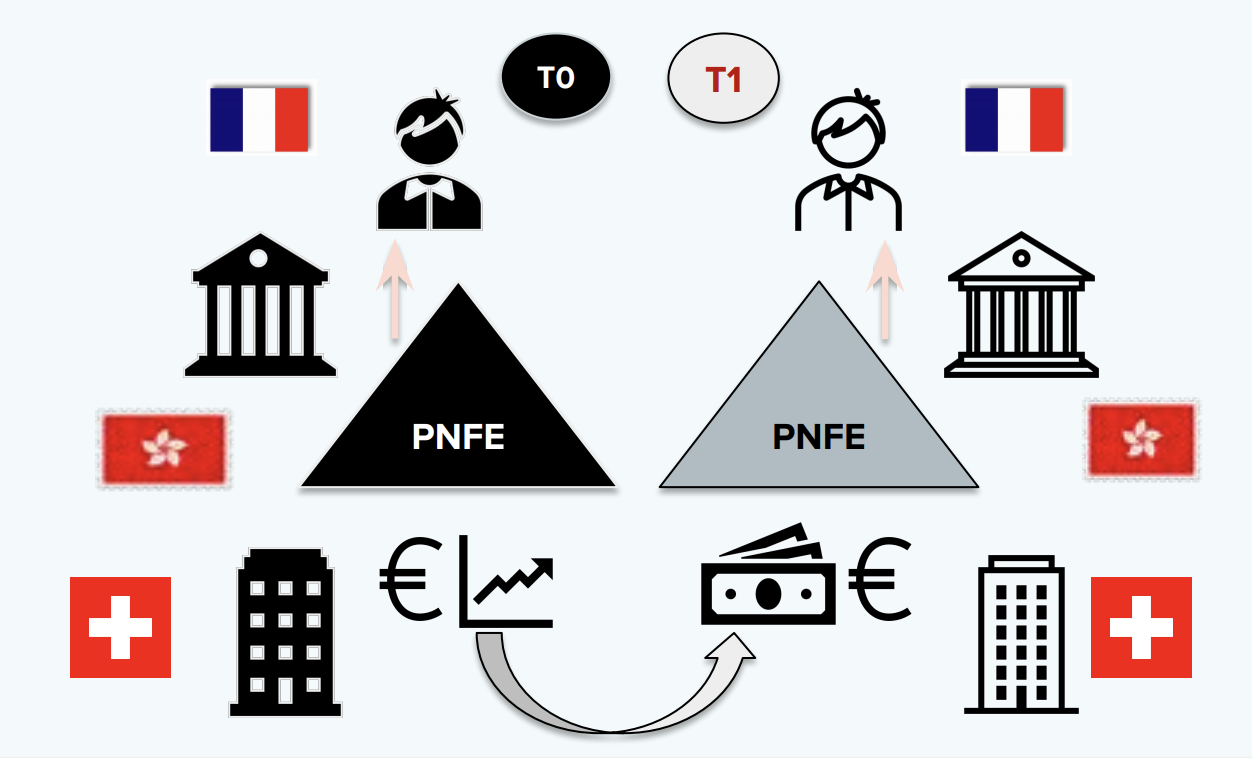

Illustrative example one you see on your screen in front of you, and as I mentioned in my brief summary, we have French set law beneficiary of a trust, trustees in Hong Kong, the trust holds in time zero, the scenario on the left pre-transaction, pre-Arrangement. The trust holds a bunch of European securities, marketable securities as designated by the euro sign in the stock market graph. And these are held with a custodial account at a Swiss bank. And then at time one, the transaction takes place, and that transaction is selling those securities and replacing them with derivative contracts. These are equity derivative contracts, and they reference the same marketable securities that were previously held in the custodial account. So from an economic standpoint, the purpose here is that there's very little change in the economic status of the assets, it's just one of the factors will come into play as we'll go into. However, other than that, the structure remains exactly the same and, key point, the settler beneficiary remains French, the trustee remains Hong Kong, and we have a Swiss bank there, and we'll discuss a little bit about what role the Swiss bank may or may not have played in this scenario.

So the first concept we're going to dive into is, what makes something a Cross-border Arrangement? Now, as I mentioned on the last webinar and virtually every webinar we have done I think, the term Arrangement is undefined in DAC6, just Arrangement, not cross-border, undefined in DAC6, certain guidance notes have taken a stab at it defining it as a scheme transaction, negotiation, I mean, the summary is, is that Arrangement is such a broad or undefined topic that you should not focus on Arrangement when determining whether something is reportable because very few if anything will ever be disqualified because it doesn't count as an Arrangement. But the term “cross-border” does have a definition and has a kind of a more detailed one than I think you might expect. And for an Arrangement to be cross-border, it has two criteria. One, it must concern either more than one EU member state or an EU member state in a third country. So there must be at least two jurisdictions involved, one of which at a minimum must be an EU member state.

And here, the question is, well, what does “concern” mean? And let's talk about this first criterion. So in this example, we have euro-denominated European securities. Does that mean it concerns the EU? And the answer is no, it doesn't. For an Arrangement to concern multiple jurisdictions, the jurisdictions themselves must be of some material relevance to the Arrangement. And typically what they're looking for, if you take a look at all of the exceptions, they're looking for anything that would have a tax consequence in that jurisdiction, or would have a CRS consequence if not a direct tax consequence. So if you see that, then you usually can say that the concerning criterion is met. And here, we can imagine, of course, the CRS issue comes into play, but there's also potential tax consequences because the settler beneficiary of these trusts is an EU resident person. So I think it's comfortable to say that the concern's criterion is satisfied.

The second criterion for an Arrangement to qualify as a Cross-border Arrangement is that one of the following conditions must be met. Not all the participants are resident in the same jurisdiction, one or more participant is simultaneously resident in more than one jurisdiction, one of the participants carries on a business in another jurisdiction via a permanent establishment, one of the other participants in the Arrangement carries on an activity in another jurisdiction. Those are the four main ones. And you could say those could apply here, except participants are only the persons who are actively taking part in the Arrangement. So here, of course, we have the Hong Kong trustees and the Swiss banks at a minimum that would qualify here.

The final criterion is certainly applicable here, and they bring back in CRS, and it feels a little bit tacked on, especially when you consider that CRS plays such a determinant role in so many other aspects of DAC6 reporting. But if it's possible that the Arrangement has an impact on CRS reporting, then that will also meet this particular criterion. So in this scenario, clearly, we meet the Cross-border Arrangement qualification. If the trustees were Swiss, we might have a slightly different scenario there, then we wouldn't necessarily have the cross-border because the active participants because. of course, the settler beneficiary is not an active participant in this Arrangement, he's a party to it, or she is a party to it and a beneficiary of the Arrangement, but not an active participant as defined under DAC6.

Do we have any EU intermediaries in this setup? Well, based on the definition of Intermediary, I think it's almost certain that the Hong Kong trustees qualify as intermediaries. But what about the banks? Well, banks may fit the definition of a service provider. They are providing relevant services to make this Arrangement work, but as we've seen, a lot of guidance notes have carved out an exception for banks, which basically allows banks not to qualify as intermediaries where their role is purely processing payments. So even if the bank would be aware, should be aware, that as they transfer these assets to some other bank where they may not be reported, there's a CRS consequence, the bank is no longer necessarily going to do CRS reporting on this account or in a different way, the bank is excused, it's got an about exemption for its payment functions. So let's explore this topic a little further.

I mentioned at the beginning that we have another Swiss bank in T1. These assets are over-the-counter derivative contracts, so they're not necessarily going to be held in a custodial account. So that bank is not customizing these assets. Is the bank issuing the derivative contract? Would that make the bank into an Intermediary? Well, it could be, but it depends on how those activities are linked together. If the custodial bank and the issuer, if it's the same entity doing both actions and they're working together to persuade clients of the bank to buy products from the same bank, then you could see a connection there. But at the same time, certain banks have different departments and one department will create equity-based derivatives and they'll just make them available on the internal bank store for bank clients, and the bank client can say I'll take A, D and F. And it's hard to say that the two different parts of the bank are working together in a way that it amounts to qualification as an Intermediary. So there I think we're at a borderline, where we definitely would cross the border line is if the bank played any advisory role in suggesting to the client that he or she purchase these derivative contracts in lieu of the securities currently held, then the bank is playing an advisory role and would clearly qualify as an Intermediary.

But as you can see, it's not always straightforward exactly who's going to qualify as an Intermediary. And of course, in this case, the answer will be none. The bank no matter what it does will not be an EU Intermediary because it's a Swiss bank. So as we currently have it set up, we do not have any EU intermediaries in this structure. Now, what does that mean? That means that to the extent this is a Reportable Cross-border Arrangement, the reporting duty doesn't fall on an Intermediary. There's no Intermediary subject to EU member state regulations and laws in this scenario. Consequences of that are that DAC6 will find someone who will have a reporting responsibility who is subject to EU laws and regulations, and of course, in this scenario, that person is the French client, the French settler beneficiary trust. As this is a CRS avoidance Arrangement because the assets that were held in the bank in T0 were held in a reportable form, but these derivative contracts that are OTC, these are a non-reportable financial asset because they're not held in a reportable form. So the reporting that's being done by the Swiss bank in time zero is no longer being done by the Swiss bank or anyone else in time one. And as mentioned, there would be no commercial purpose for converting these securities into derivative contracts as the economic situation is identical, and therefore it's very straightforward, clean-cut case of CRS avoidance, in my view. It's designed to be. The Hallmarks are not what we're looking at here. So we have now a Reportable Cross-border Arrangement, but no EU intermediaries to report on it, and the consequences of that are that the French Relevant Taxpayer is burdened with a reporting duty for this particular transaction.

Let's change up the facts a little bit to make it more interesting. What if this Hong Kong trustee was a member of the UK bar? Now, that shouldn't matter because they're still in Hong Kong and they don't have any operations in the UK, except DAC6 does have a criterion, its criteria for being EU are that you are incorporated there, resident there, place of management and control or you're a permanent establishment operating there, but there's a fourth criterion which says if you are a member of a professional organization in the fields of tax accounting or consulting, then that two qualifies you as an EU Intermediary, assuming you're actually an Intermediary, as an EU person for purposes of DAC6. So if we hypothetically surmise that the Hong Kong one is a member of the UK bar, he or she would be a member of an EU based professional association.

Now fortunately, that’s a very broad concept because as stated, it could cover an enormous array of organizations and memberships with those organizations and has been gradually narrowed by several of the guidance notes that we've seen. And it seems like the prevailing view is yes, membership in an organization counts, but it has to be the type of organization that controls your professional license and can strip you of that professional license or something along those lines. Therefore, being a member of step UK STEP does not qualify you as an EU Intermediary, but being a member of a Bar Association probably would. So here now we've transformed the Hong Kong trustee into an EU Intermediary.

At first, this would relieve the French Relevant Taxpayer of any reporting duty because there is an EU Intermediary and therefore, they have the primary responsibility to submit the report on this Reportable Cross-border Arrangement. But because this Hong Kong trustee is a member of the UK bar, they have access to Legal Professional Privilege, and Legal Professional Privilege, more or less depending upon which jurisdiction you're in, states that to the extent that the communications that would need to be reported under DAC6 would be subject to local attorney client privilege standards, then you as the legal party are exempt from disclosing that information. You're not allowed to, even if you wanted to. The consequences of the trustee invoking Legal Professional Privilege is that once again, we have no EU Intermediary who is able or allowed to submit the reports.

Were the Legal Professional Privilege standard applicable, then the Hong Kong trustee, it has to notify all other intermediaries that there is a Reportable Arrangement, but they're not allowed to report on it. So those other intermediaries might need to take up the task, and/or because it depends on the jurisdiction again, they need to notify the Relevant Taxpayers the same thing: There is an Arrangement, it's reportable under DAC6, there's no Intermediary capable of reporting it and therefore you have the responsibility because I have attorney-client privilege. Now of course, the client can waive it. So the Hong Kong trustee might notify the French taxpayer, the French client, LPP (Legal Professional Privilege), I can't do this report and the French taxpayer will be like, I waive the LPP, I waive the privilege, submit the report. But you can see the mechanics of the reporting will change a lot where you have no EU nexus to the Arrangement or where the sole party with the EU Nexus can and will invoke Legal Professional Privilege.